Navigating the complex business world can be daunting, especially when planning your exit.

Exit strategies are crucial for any business owner. They provide a roadmap for transitioning out of your business.

But crafting an effective exit strategy is no easy task. It requires careful planning, foresight, and expert advice.

That’s where exit strategy advisors come in. They offer invaluable guidance to ensure a smooth transition.

In this article, we’ll delve into the role of these advisors. We’ll explore how they can help you maximize value and achieve your business goals.

Whether you’re considering selling, merging, or passing on your business, this guide will provide the insights you need. Let’s get started.

Understanding Business Exit Strategies

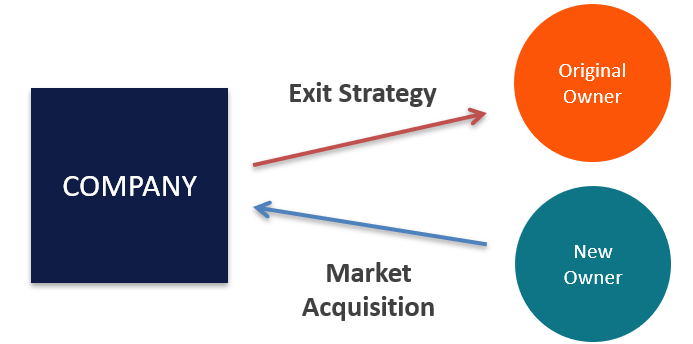

A business exit strategy is a plan for how you will sell or transfer your business. It’s a roadmap for the end of your business journey.

But why is an exit strategy so important?

Firstly, it helps you maximize the value of your business. By planning ahead, you can make strategic decisions that increase your business’s worth.

Secondly, it ensures business continuity. Having a plan for when you leave your business will help if you are giving it to a family member or selling it.

Here are some key elements of a business exit strategy:

- Valuation: Understanding the worth of your business is crucial. It helps you set a fair selling price.

- Timing: The right time to exit can vary. It depends on market conditions, your personal goals, and the state of your business.

- Succession: If you’re passing on the business, who will take over? Succession planning is key to ensuring continuity.

- Sale Process: If you’re selling, how will you find buyers? How will you negotiate the sale?

In the next section, we’ll explore how exit strategy advisors can help with these elements.

The Role of Exit Strategy Advisors

Exit strategy advisors are professionals who guide business owners through the exit process. They bring expertise in areas like finance, law, and business strategy.

One of their key roles is to help you maximize the value of your business. They can suggest improvements and strategic decisions that increase your business’s worth.

Exit strategy advisors also assist with succession planning. They help identify potential successors and prepare them for their new roles.

Finally, they guide you through the sale process. From finding buyers to negotiating the sale, exit strategy advisors are there every step of the way. They ensure that you get the best possible outcome from your business closure.

Types of Exit Strategies

There are several types of exit strategies that business owners can consider. The choice depends on various factors, including the owner’s goals, the business’s nature, and market conditions.

One common strategy is selling the business. This can be sold to someone outside, like a competitor, or to someone inside, like an employee or family member.

Another strategy is merging with another company. This can provide a smooth transition and ensure the business’s continuity.

Here are some common types of exit strategies:

- Selling the business

- Merging with another company

- Passing the business to a family member

- Liquidating the business

- Initial Public Offering (IPO)

Each strategy has its pros and cons. It’s crucial to consider your personal and business goals when choosing the right one. Exit strategy advisors can provide valuable insights to help you make the best decision.

The Importance of Succession Planning

Succession planning is a critical part of any business exit strategy. It ensures that the business continues to operate smoothly after the owner’s departure.

A well-crafted succession plan outlines who will take over the business. It also details the training and preparation needed for the successor. This helps to minimize disruption and maintain business continuity.

Engaging exit strategy advisors in succession planning can be beneficial. They can provide expert guidance to ensure a seamless transition, safeguarding the business’s future and its stakeholders.

Maximizing Business Value with Advisory Services

Advisory services play a crucial role in maximizing business value. They help identify areas of improvement and implement strategies to enhance profitability.

Exit strategy advisors can provide insights into market trends and valuation methods. This knowledge can be leveraged to increase the business’s worth before an exit.

By engaging advisory services, business owners can ensure they get the best possible outcome. This includes a higher selling price and favorable terms during the exit process.

Steps in Exit Planning

Exit planning is a multi-step process that requires careful thought and preparation. The first step is to define clear objectives for the exit. This includes financial goals, timing, and future involvement in the business.

The next step involves understanding the business’s current value. This is crucial in setting realistic expectations and planning for value enhancement.

The third step is to identify potential exit options. These could include selling the business, merging with another company, or passing it on to a family member.

Finally, a detailed exit plan is developed. This plan outlines the steps to be taken, timelines, and responsibilities to ensure a smooth transition.

Choosing the Right Exit Strategy Advisor

Choosing the right exit strategy advisor is a critical decision. The advisor should have a deep understanding of your business and industry. They should also have a proven track record in managing successful exits.

The advisor’s role is not just to guide the exit process. They should also help maximize the business value and negotiate the best terms. Their expertise can make a significant difference in the outcome of the exit.

Finally, the advisor should be someone you trust. They will be handling sensitive information and making crucial decisions. Therefore, it’s essential to have a strong, trusting relationship with them.

Conclusion: Preparing for a Smooth Transition

In conclusion, exit strategy advisors play a crucial role in ensuring a smooth transition. They provide valuable insights and guidance throughout the process.

With the right advisor, you can maximize your business value and achieve your exit goals. So, start planning your exit strategy today.